Clear definition of operational requirements in terms that a 3PL partner can understand and use to design effective operations is critical. These definitions are needed to select a 3PL partner, receive the most cost effective pricing, and manage an ongoing 3PL relationship. Effectively defining receiving operations for potential outsource partners requires specifically addressing key attributes of each logistics function.

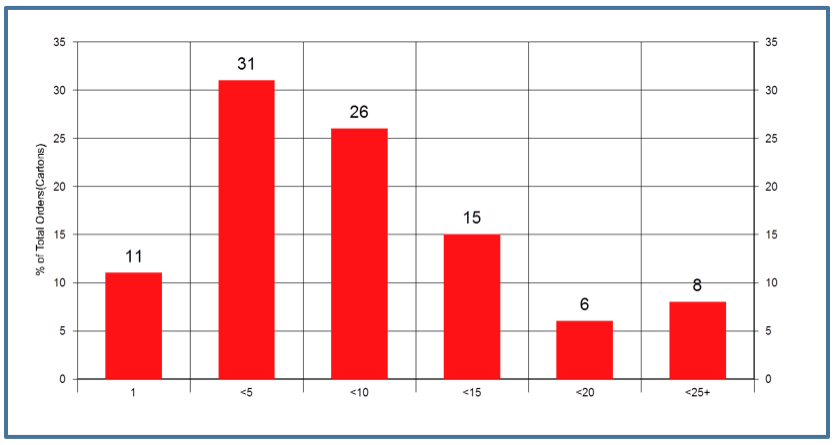

Information regarding outbound operations can be much more complex and difficult to quantify for a potential 3PL partner. Customer order characteristics can vary by product line, business segment, season of the year, promotional calendar, and other reasons. Averages may be very deceiving to both the user and the 3PL if orders are not homogenous and if profiles are not fully quantified and understood (See Figure 1).

For example, if outbound orders are comprised of both case picks and full pallet picks, the resulting average mix may vary significantly from day to day or customer to customer. Activity details by operation or function must be provided in order to design efficient operations and achieve the most competitive rates. These activities should be quantified in terms and units of work that the 3PL associates will perform, whether eaches, units, cases, pallets, etc.

Figure 1

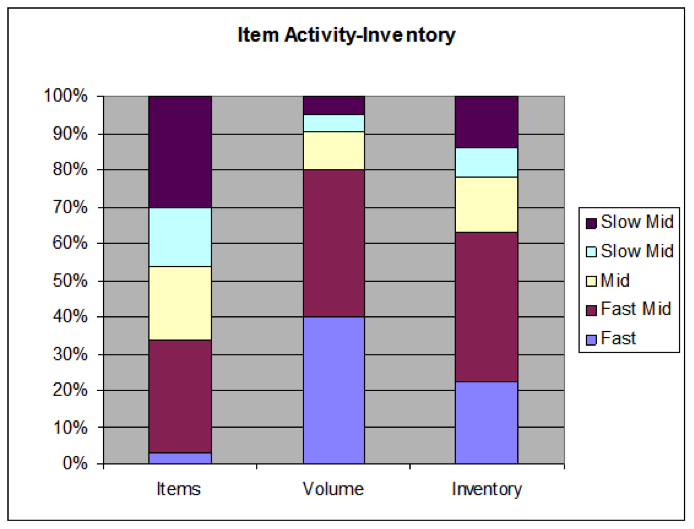

Inventory requirements and movement characteristics impact storage technologies and space utilization (See Figure 2). Typical company data which is normally tracked and available may include total dollars, units, cases, and dollar turnover. For parts distribution operations, units may be the appropriate storage metric, but for most operations, some form of pallet storage is also appropriate. Specifying the total skus and pallets stored for potential 3PL partners is necessary but not sufficient for an effective warehouse layout. Acceptable stack heights by sku and details of planned inventory and movement by sku are critical to efficient layout and space utilization.

In the case of a food manufacturer, the reported inventory may be 250 skus and 5,000 pallets with and average stack height of 3 (and the method of computing the average stack height is questionable). Twenty pallets per sku with a stack height of 3 may indicate that 4 deep floor storage would be an efficient layout and a 3PL may quote this business on that basis. In reality, if a significant amount of the inventory stacks single high and a very limited number of skus comprise the majority of the inventory. A combination of deeper floor lanes and selective use of pallet rack would render a significantly smaller space footprint and a more economical price for the user.

Figure 2

Breaking each operation into its sub-component movements and quantifying material flows is critical for communication to potential 3PL partners. Defining the number of “touches” and the profiles and relationships between movement and inventory of specific items in stock is much more effective than simply computing and communicating averages.

Did you see Part 1 to 3LP Selection?

As of September 8, 2020, Crimson & Co (formerly The Progress Group/TPG) has rebranded as Argon & Co following the successful merger with Argon Consulting in April 2018.